At the very core of the Baiia identity is a desire to bring positive change to the world around us, especially when it comes to creating a more compassionate, inclusive space for women the world over to thrive. This Women’s History Month we are honoured to celebrate the women of the past and present working tirelessly to create a more inclusive and equitable world.

Now we turn our attention to the women who need our help.

We’re incredibly proud to announce our charity partnership with the Women’s Microfinance Initiative. Between the 22nd - 28th of March, we will be donating 10% of all Baiia profits to this small non-profit whose dedication to the lowest-income groups of women in East Africa, is bringing long-lasting, self-sustaining change to these local communities.

GET TO KNOW WMI

“Building Assets for Better Lives”

WMI is a US-based charity, launched in 2008, that believes financial inclusion should be available to everyone, and that every woman, no matter what social standing deserves financial autonomy.

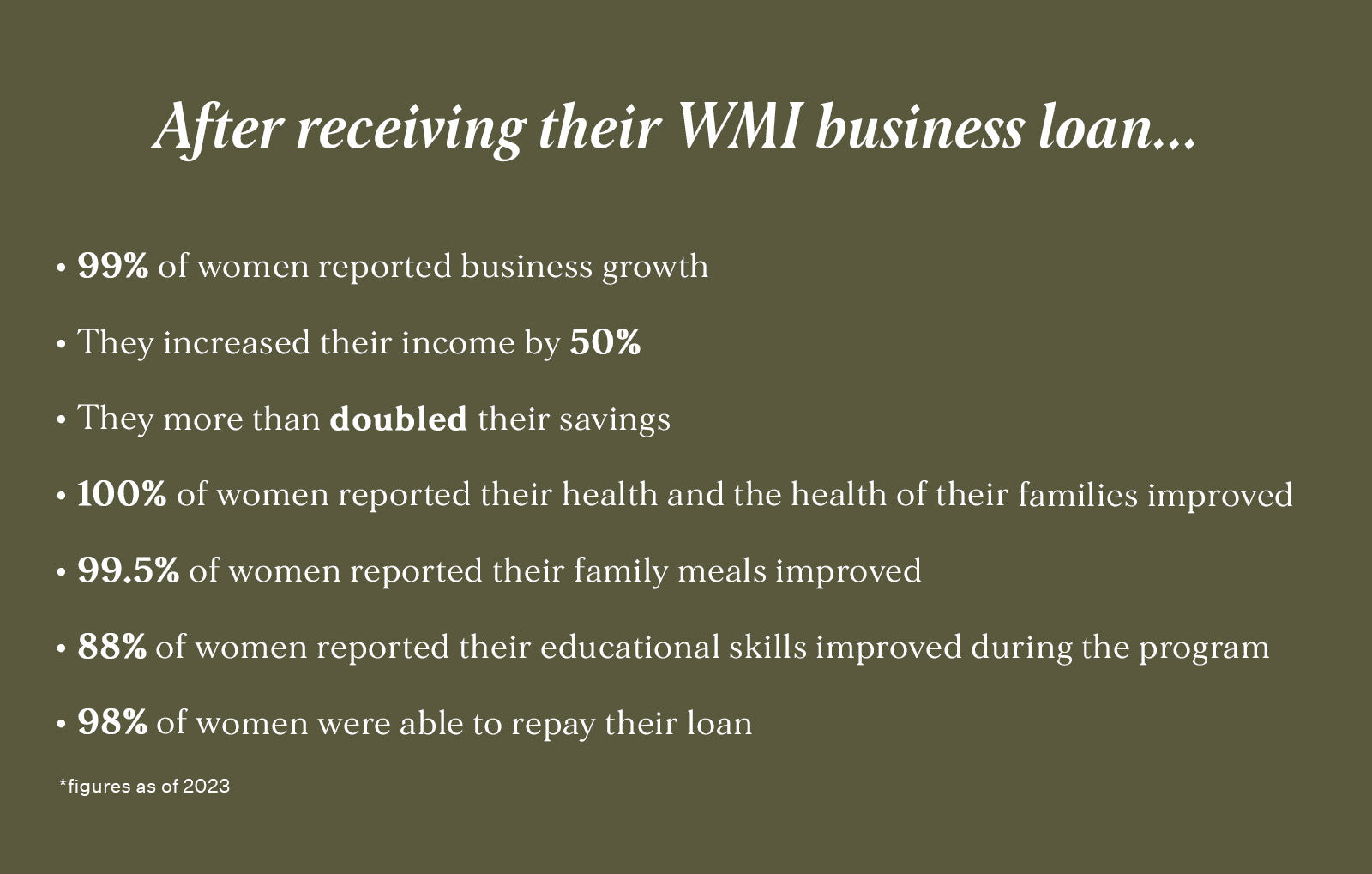

Since its inception, over 95,000 loans have been issued to women in need.

WMI’s microfinancing endeavours create village-level loan hubs (managed by local women who are leaders in their communities), that offer basic financial services, such as credit and deposit-taking, on a very small scale, to historically marginalised groups that do not meet the criteria to do business with conventional banking institutions. They are farmers, shoemakers, chefs, tailors, hairdressers, saleswomen, and more - often with a family to support.

By issuing affordable, collateral-free loans for as little as $50, WMI promotes women's economic participation and carries the hope of prosperity to low-income, rural areas of Uganda, Kenya and Tanzania. By providing credit to start small businesses, microfinance is empowering these women to raise themselves out of the cycle of poverty. These microfinance initiatives are changing the face of poverty one borrower at a time, encouraging economic stability through income generation rather than subsidies.

WMI loans are distributed four times throughout a two-year cycle and unlike many other financial lending hubs, they do not require borrowers to provide any collateral or down payment. Over each six-month loan cycle, borrowers make ten repayments, covering their principal, plus 10% flat interest. The interest covers WMI’s operational costs on the ground (salaries, supplies, transport, training, etc.) and their community outreach projects. Repaid loan funds are retained by each loan hub and recycled to fund loans for new borrowers. With this model, each loan hub generates enough income to financially sustain itself.

As a female-founded company, we understand the importance of women supporting and lifting each other up, in life as much as in business. We are immensely proud to amplify the voices of these women to our incredible community.

We encourage you to assist us in supporting their journey to becoming successful businesswomen who help their communities flourish and support their families by securing your next Baiia purchase before the 28th of March.

Learn more about the incredible story behind WMI and the women they have helped by visiting their website and social media pages here!